Income Tax and Financial Planning News 2024-2025

With the new tax season upon us, here are the main income tax and financial planning developments for 2024-2025.

Enjoy your reading!

Table of Content

Owners

Co-ownership fees

Non-conforming short-term rentals

Credit for wastewater treatment

Investments

Capital gains

Cryptoassets (e.g. cryptocurrencies)

Alternative Minimum Tax (AMT)

Retirees

Québec Pension Plan (QPP)

Elders

Tax credit for home support

Credit for seniors’ activities (age 70 and over)

General

Canadian Dental Care Plan (CDCP)

The federal government is phasing in the dental insurance plan (CDCP) in 2024.

Eligibility requirements :

- Being a Canadian citizen

- Having a net family income of less than $90,000

- Having no access to a private dental plan

Eligible persons :

- 65 years old or over

- Under 18 years old

- Disabled

How it works

Eligible individuals receive a letter from Service Canada inviting them to register to the program.

They can then call 1-833-537-4342 to register, providing the following information :

- Code included in the letter

- Social insurance number

A welcome kit is then sent to the eligible person by Sun Life Company, which has been mandated by the federal government to administer the program. The eligible person can then make an appointment with the dentist, ensuring that he or she has also registered to the program.

Dentists can register voluntarily to the program administered by the Sun Life company. Dentists receive reimbursements directly.

It is to be noted that contrary to the Québec Drug Insurance Plan, there is no premium payable for the federal dental insurance plan.

Services covered

The main services covered are as follows:

- Diagnostics (e.g. examinations, X-rays)

- Restoration (e.g., dental caries, crowns)

- Endodontics

- Prevention (e.g. polishing, scaling)

- Prosthodontics (e.g. dental protheses)

- Oral surgery

- Orthodontics

The program imposes certain limits on the frequency of services eligible for reimbursement.

Reimbursements

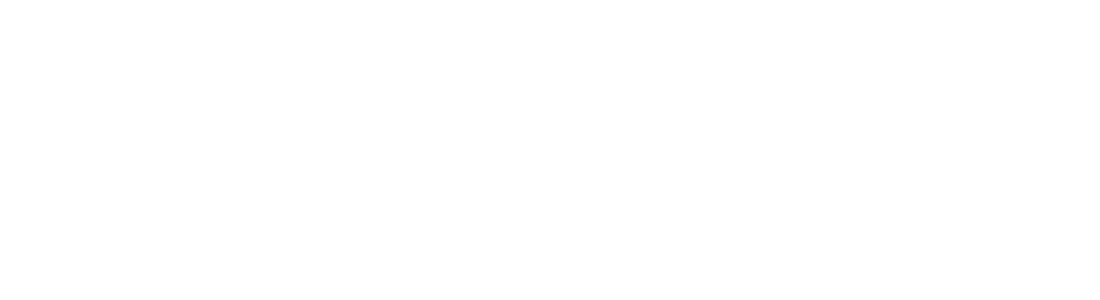

Dental expense reimbursements vary according to net family income.

This supplement may also qualify as a medical expense when preparing personal tax returns.

Electronic remittances or payments over $10,000

Since January 1, 2024, federal and Quebec income tax payments over $10,000 must be made online (e.g., Internet, your financial institution’s website). Penalties may apply unless special circumstances make it impossible to pay online.

Digital news subscription credit

This federal credit of up to $63 for a maximum expenses of $500 can be claimed for the last time in 2024.

Workers

The Tax-Free Savings Account (TFSA)

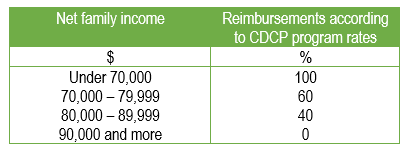

In 2025, the TFSA annual limit remains at $7,000, and the cumulative limit since 2009 is $102,000.

Registered Retirement Savings Plan (RRSP)

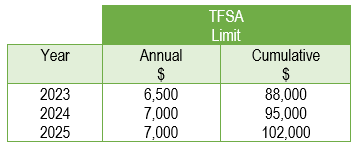

The RRSP contribution limit increases from $32,490 in 2025 to $33,810 in 2026, or 18% of the previous year’s earned income.

Workers who participate in an employer-sponsored pension plan must take into account a reduction in their maximum RRSP contribution corresponding to the pension adjustment (PA) shown in box 52 of the T4. The RRSP limit for incorporated professionals participating in an Individual Pension Plan (IPP) is $600.

Quebec Labour Funds (FTQ and Fondaction)

High-income individuals

The Quebec government has announced that, starting in 2027, individuals with a taxable income of over $130,000 in 2025 (corresponding to the income starting at which the maximum tax rate applies) will no longer be entitled to the 15% Quebec tax credit associated with labour-sponsored funds. Income will be determined on the basis of the income tax return of the 2nd preceding year, i.e. 2025.

Extended minimum holding period

The minimum holding period to qualify for the tax credit is gradually extended from 2 to 5 years for shares acquired after June 1, 2024, 2025 and 2026.

Lump-sum contributions and deductions

- FTQ Fund

Since the pandemic, the FTQ Fund has limited lump-sum contributions (max $5,000) and monthly deposits from bank accounts. However, people who were already making monthly contributions can continue to do so. For new contributions, the FTQ Fund periodically holds a draw for random allocation. Unfortunately, the most recent draw has ended, since registration was required for the period of December 16, 2024 to January 24, 2025. Interested parties should check the FTQ Fund website from time to time for future draw periods.

- Fondaction CSN

Lump-sum contributions or monthly transfers are still allowed by Fondaction.

Families

Parental union

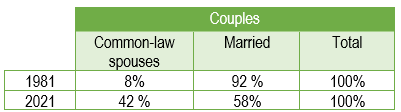

On May 30, the Loi portant sur la réforme du droit de la famille et constituant le régime d’union parentale was passed by the Quebec National Assembly and subsequently given assent on June 4, 2024.

The new parental union regime will automatically apply to common law spouses having children together born after June 29th, 2025.

This new measure is not retroactive, so couples with children born before that date will not be covered by the new Act.

The regime will apply to reconstituted families only if the spouses have a child in common born after June 29, 2025.

Purpose of the plan

The main objective of the new Act is to protect children in the event of a separation of common-law spouses.

Indeed, at the time of introducing the bill, Justice Minister Simon Jolin-Barette indicated that 65% of children in Quebec are now born out of marriage.

Highlights of the new regime

1) Parental union patrimony

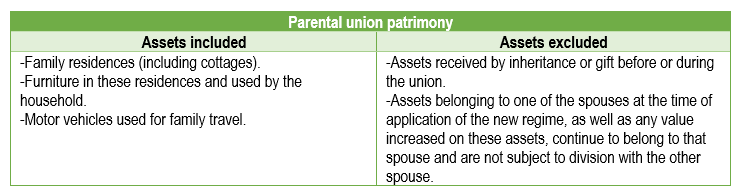

The new plan provides for the creation of a new parental union patrimony, the value of which can be shared 50%/50% between the spouses in the event of separation or death.

Unlike the Loi sur le partage du patrimoine familial or the Regime de société d’acquêts in the case of married couples, pension plans (RRSPs and employer-sponsored pension plans) are not covered by the new parental union plan.

2) Temporary right to use the family home

In the event of separation, the spouse with custody of the children may remain in the family home for a certain period of time, to ensure a smoother transition for the children.

3) Death

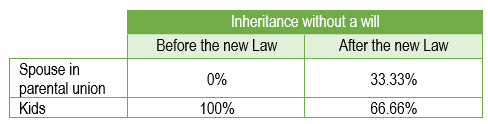

In the case of an succession without will (ab intestate), a spouse in a parental union will now be recognized as a legal heir if they have been living together for more than a year.

Note that the value to which the surviving spouse is entitled in the parental union patrimony (e.g., residences, furniture, automobiles) must be paid to him or her first. The remainder of the estate after settlement will be divided 33.33% to the spouse and 66.66% to the children.

Naturally, a will can be drawn up to change the distribution of the residue of the estate according to the wishes of the deceased.

4) Compensatory allowance

The new regime favors payment of a compensatory payment rather than spousal support.

In the event of separation or even death, a spouse may apply to the court for a payment allowance in recognition of his or her impoverishment due to his or her contribution to the enrichment of the other spouse.

The benefit may be payable in cash or in instalments.

For example, a compensatory payment could be payable in the following situations:

-Contribution to the spouse’s business without adequate remuneration;

-Financial support during spouse’s studies;

-Professional sacrifice for the benefit of the family;

-Management and upkeep of joint property, contributing to an increase in its value.

It should also be remembered that spousal support payments for the benefit of the children can be allowed by the court, whether you are married, in a parental union or common-law spouses.

5) Renunciation to the new regime

The spouses will be allowed to renounce by mutual agreement in a notarial deed to the application of the provisions of the new plan within 90 days after the beginning of the parental union (i.e.: at the birth of a child after June 29, 2025). In this case, parental union patrimony is presumed never have been constituted.

Spouses in a parental union will also be able to choose by mutual agreement in a notarial deed to exclude certain assets otherwise included in the parental union patrimony (e.g. residences, furniture, automobiles).

It is important to note that even if a couple has excluded themselves from the application of the parental union patrimony, the spouse in parental union still qualifies as a legal heir (see point 3).

Futur owners

Home Buyer’s Plan (HBP)

Increased ceiling

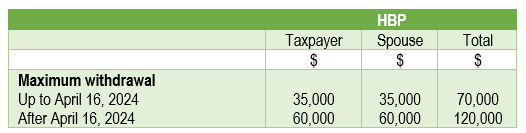

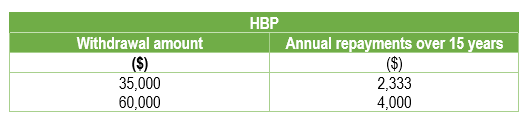

The HBP withdrawal limit has been raised from $35,000 to $60,000 for withdrawals made after April 16, 2024.

As a result of this increase, spouses could withdraw a maximum of $120,000 from their RRSP when purchasing their first home.

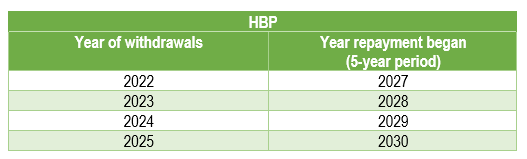

Delay for the start of repayments extended

In addition, the delay to start repayments has been extended from 2 to 5 years for withdrawals made between January 1, 2022 and December 31, 2025. Repayments are then spread over a 15-year period.

Examples of annual repayments over 15 years :

Owners

Co-ownership fees

Following the adoption of Bill 141 and Bill 16, many owners are seeing, or will see, a significant increase in their co-ownership fees, particularly in the case of older buildings.

The main goal of these new laws is to improve the management of condominiums, so that they are adequately insured and have sufficient funds to carry out short, medium and long-term building maintenance.

In this regard, many will recall the collapse of a 12-storey building in Surfside, Florida, on June 12, 2021, which resulted in the deaths of over 90 people, including several Quebecers. This event highlighted deficiencies in the maintenance of condominiums, and prompted the authorities in both the United States and Canada to improve their oversight of this sector.

Highlights

1) Insurance requirements (Bill 141)

- Insurance covering reconstruction value in the event of a major disaster. The reconstruction value must be evaluated by an accredited appraiser at least every 5 years.

- Directors’ and officers’ liability insurance.

2) Maintenance logbook (Law 16)

The syndicate is required to draw up a building maintenance schedule to help anticipate short, medium and longterm maintenance costs. The maintenance book must be prepared by an authorized expert and updated at least every 5 years.

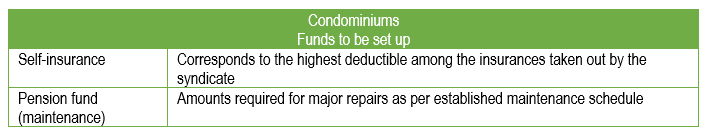

3) Reserve funds to be set up

It’s clear that the new requirements for insurance coverage and the creation of co-insurance and contingency funds for maintenance will lead to a sometimes substantial increase in co-ownership fees.

Hectic co-owners’ meetings to be expected…

4) New buyers

The syndicate of co-owners must be able to provide an attestation of the condition of the co-ownership when a unit is sold.

Non-conforming short-term rentals

In an effort to curb real estate speculation, the federal government announced in its fall 2023 economic statement its intention to disallow rental expenses (e.g., mortgage interest, property taxes, insurance, condominium fees) starting in 2024 when short-term rentals:

- is prohibited in the province or municipality;

- does not meet provincial or municipal licensing or registration requirements.

Credit for wastewater treatment

(e.g. septic tanks, septic fields)

The period for claiming a tax credit for expenses related to the construction or renovation of wastewater disposal systems has been extended to March 31, 2027. The maximum credit is $5,500, or 20% of $30,000 in eligible expenses (the first $2,500 in expenses is not eligible).

Investments

Capital gains

Few tax issues have caused so much discussions, only to finish in a deadend.

This measure, announced in the Federal Budget of April 16 2024, provided for an increase in the inclusion rate from 50% to 66% in certain situations on capital gains realized after June 25, 2024. Although part of the Notice of Ways and Means Motions tabled on September 23, 2024, this measure was not given assent.

In the end, we can predict that this measure will probably never be adopted as presented.

Indeed, Conservative Party leader Pierre Poilièvre announced on January 16 2025 that he would not adopt the measure if his party were elected in the next federal election.

Subsequently, the two main candidates to succeed Justin Trudeau as Liberal leader, Chrystia Freeland and Mark Carney, announced that they would not adopt this measure.

If you would like more information on the proposed measure, please consult the bulletin we wrote on the subject in May 2024.

Cryptoassets (e.g. cryptocurrencies)

(Form TP-21.4.39-V)

Example of cryptoassets:

- Cryptocurrency (e.g. Bitcoin)

- Security tokens

- Non-fungible tokens (NFT)

- Utility tokens

Gains on cryptoasset transactions may be considered capital gains or business income, depending on the circumstances. In addition, transactions may be subject to commodity taxes (GST-QST). Don’t hesitate to discuss this with your advisor.

Potential penalties

Failure to file this new form may result in a penalty of $10 per day (maximum $2,500) after the tax return filing due date (April 30 or June 15 in the case of self-employed workers). In addition, Revenu Québec may impose a $100 penalty for each item of information omitted or erroneous on the form.

It should be noted that these penalties are in addition to those that could be imposed on tax payable on undeclared income gains relating to cryptoasset transactions.

Alternative Minimum Tax (AMT)

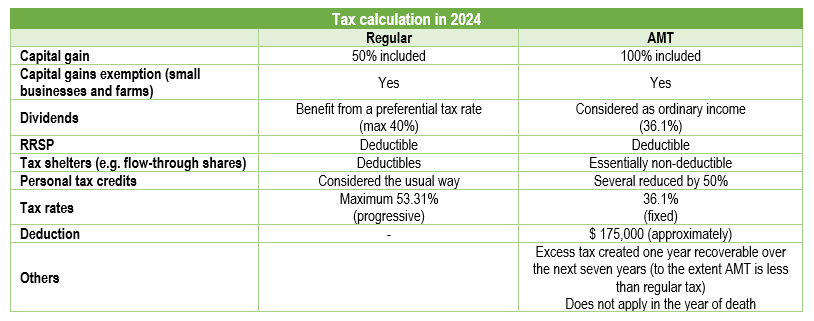

The AMT concept was introduced in 1986. It is a personal tax calculation that runs parallel to the regular tax calculation on schedules T691 (federal) and TP-776.42 (Quebec).

At the time, the government’s main objective was to limit the use of tax shelters (e.g. flow-through shares, films, QSSP, etc.), which were very popular in the 80s.

Very few clients have been affected by the AMT in recent years. Those who have, often because of an exceptional year (e.g., large capital gain, tax shelters), have generally been able to recoup the AMT surplus the following year as their situation returned to normal. The following table summarizes the main differences between the regular tax calculation and the AMT calculation as of 2024.

The new rules are likely to have a particular impact on individuals with large capital gains.

It is to be noted that, as mentioned in the table, the AMT does not apply in the year of death.

Don’t hesitate to consult our Tax and Financial Guide on our web site for more information.

Retirees

Québec Pension Plan (QPP)

Many changes have recently been made to the QPP.

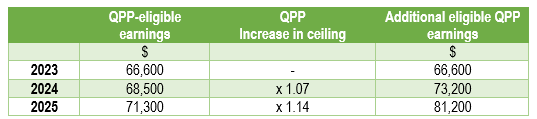

Increase in eligible salary

Over the next two years, the maximum salary on which contributions and pensions are calculated will increase significantly.

Gradual increase in annuity percentage

Over a period of about 40 years, workers will gradually see their pension percentage increase from 25% to 33.33% of pensionable earnings.

The maximum QPP pension could then reach at age 65 approximately $26,600 (33.33% x $80,000) in today’s dollars.

Option to stop contributing to the QPP at age 65

A worker aged 65 and over who receives a QPP pension may elect to stop contributing to the QPP as of 2024. This choice may be modified at a later date.

Pension deferral election period extended to age 72

The QPP pension can be claimed as early as age 60. It was previously possible to defer payment until age 70. It is now possible to defer payment until age 72. The guide on our website outlines key factors to consider to make an informed choice.

Pension protection after age 65

A retiree who chose to defer his or her pension after age 65 could suffer a negative effect on the calculation of his or her pension because he or she earned little or no work income during the deferral period and did not benefit from the full 7.2% annual increase per year of deferral after age 65.

Cessation of contributions at age 73

Contributions cease automatically on January 1 of the year during which an employee reaches the age of 73.

Elders

Tax credit for home support

(age 70 and over)

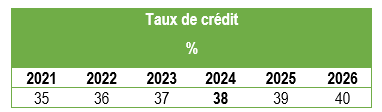

The basic credit rate of 35% in 2021 is increased to 38% in 2024 and will continue to increase by 1% per year thereafter, up to 40% in 2026.

Credit for seniors’ activities (age 70 and over)

The credit was abolished in 2023.