Fiscal and Financial Planning Guide 2024-2025

Workers > Canada training credit (CTC) (25 to 65 years old)

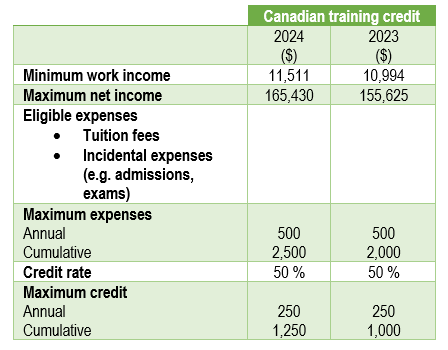

In 2019, the federal government introduced a training tax credit for workers from age 25 to 65 to help them stay up to date and improve their skills.

A worker who pay tuition fees in a years is able to claim a training credit of 50% up to the amount of the training credit accumulated at that time.

Eligibility

To accumulate a $250 credit in 2023, the individual must:

- be aged at least 25 and not more than 65 at the end of the year;

- have work income (salary or self-employed) of at least $11,511 for that year. The following types of income are also eligible : employment insurance, Québec Parental Insurance Plan payments and taxable scholarships.

- Have an individual net income lower than $165,430.

The excess eligible fees over the cumulative CTC can be claimed as tuition fees during the year. However, the tuition credit is only 12.5% at the federal level and 8% in Quebec, compared with 50% for the training credit.