Fiscal and Financial Planning Guide 2024-2025

Retirees > Québec Pension Plan (QPP)

History

The Quebec Pension Plan (QPP) came into effect in 1966. The contribution rate at the time was 1.8% for employees and 1.8% for employers. The maximum salary on which employees could contribute was $5,000.

As we’ll see later, things have changed a lot since then, as the government has made numerous modifications and improvements over the years of the plan’s existence. In 2025, the contribution rate is 6.4% for employees and 6.4% for employers up to a maximum salary of $71,300 and 4.7% on the salary bracket between $71,300 and $81,200.

The successive increases in the contribution rate, whose main aim was to ensure the sustainability of the plan in the context of an aging population, have given rise to much debate over the years.

Indeed, the government wants to act like a good head of family by forcing workers to save for their retirement. But for many workers having an average income, compulsory QPP contributions reduce the personal saving amounts available for their RESPs, RRSPs, TFSAs or TFFHSA, which could enable them to adopt a savings strategy better suited to their personal situation.

Contributions

Contribution period

- Start at age 18, calculated on earned income

- Ceases when workers stop working and no later than January 1 of the year in which the worker reaches age 73 if he continues to work.

- It is possible to stop contributing at age 65 when receiving a QPP pension.

Contribution rates

The following table illustrates the QPP contribution rate in 2025.

As you can see, contributions for a self-employed worker (maximum $9,470) are significantly higher than those for an employee (maximum $4,735), i.e. twice as much. Note that in the case of an employee, the employer pays the other half (maximum $4,735).

This is the case, for example, of an incorporated professional whose company pays him a salary. He will personally contribute $4,735 to the QPP, while his company will pay another $4,735.

Pension

Pension commencement

The QPP pension can be claimed no earlier than age 60 and no later than age 72, subject to a reduction of 6% per year of anticipation before age 65 and an increase of 8.4% per dererral year after age 65.

Pension amount

The normal retirement age under the QPP is 65. To be entitled to the maximum QPP pension of $17,196 in 2025, workers must generally:

- Have contributed for at least 35 years since the age of 18. Note that a mothers with children under age 7 and earning less than $3,500 can subtract these years when calculating the 35 years required by the QPP so they won’t be penalized;

- Have earned the maximum QPP-eligible salary throughout their career since the age of 18. It should be noted that the QPP salary requirement of $66,600 in 2025 was $ 10,400 in 1978, the year in which a person aged 65 in 2025 was 18 (age at which contributions begin).

Maximum pension

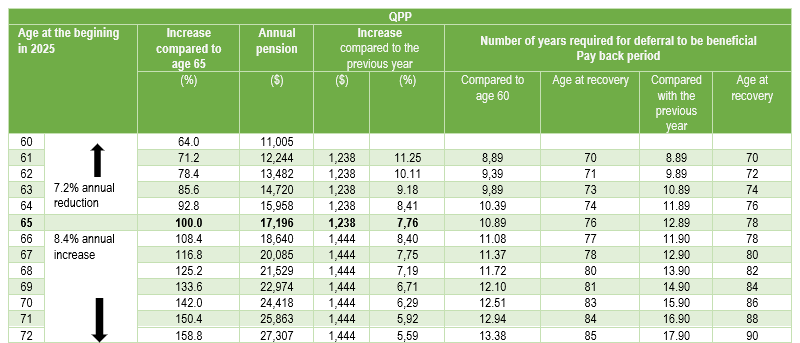

The following table illustrates the maximum pension at age 65 ($17,196 in 2025) and the effect of the 7.2% annual reduction when claiming the pension before age 65 or the 8.4% annual increase when choosing to defer the pension after age 65.

Notes :

- These projections are in constant dollars (without indexation).

Increase in QPP maximum pensionable earnings

Until now, the maximum pensionable earnings (MPE) for QPP purposes corresponded to the average industrial wage, published annually by Statistics Canada ($71,300 in 2025).

Over the next two years, the MGA will increase significantly, reaching 114% of the average industrial wage. It will then be indexed to inflation in subsequent years.

Workers earning more than the MPE will thus be entitled to receive higher pensions, and will also benefit from the gradual increase in the pension percentage from 25% to 33.33%. At maturity, younger workers earning $81,200 or more could therefore expect a pension of around $27,000 in today’s dollars (33% x $80,400), provided they have contributed enough years, generally 35 years.

Gradual increase in pension from 25% to 33% of pensionable earnings

Since its creation, the pension paid at retirement has corresponded to 25% of the average worker’s salary, subject to the maximum pensionable earnings ($71,300 in 2025).

Younger workers will benefit most from the increase in the rate based on the number of years of contributions.

Few workers are entitled to the maximum pension

It is to be noted that only 2.8% of workers are entitled to the maximum QPP pension, as shown in the table below:

Source : CFFP, Université de Sherbrooke, Septembre 2023, Quand débuter ses prestations de retraites, Les Avantages de la flexibilité Retraite Québec (2021) Statistique de l’année 2020 p.6

There are two main reasons for this:

- The maximum salary used by the QPP is the average industrial salary for large companies in Canada (200 employees or more) published annually by Statistics Canada. The average wage in Canada is about $10,000 lower than the average industrial wage used by the QPP. As a result, a majority of workers earn less than the salary required to obtain the maximum QPP pension.

- It is difficult to reach the required 35 years of contributions (late start of career after university, illness, remuneration in the form of dividends rather than salary by incorporated professionals, etc.).

To postpone the pension or not?

We could determine the ideal age from a financial point of view to claim the QPP pension if we could predict the future (e.g. age of death, inflation rate, effect of the pension on tax credits and other social programs).

Unfortunately, there are too many imponderables. This is a situation where forecasts can vary widely. As an old mathematics professor used to say, “The result of an operation cannot be more precise than the least precise of its components”.

In such a situation, it’s best to rely on certain basic principles.

Consider the number of years to recuperate deferred years

Another angle is to consider the number of years required for the higher pension obtained through deferral to recover the pension amounts sacrificed during the deferral period.

Thus, as illustrated in the last column of the table, if we choose to take the annuity at age 67, for example, it will take 11.4 years to obtain the same annuity accumulation, i.e. at age 78.

It is important to note that :

- The previous projections shown in the table are intended as trends only. They do not take into account factors such as pension compensation, maximum increase in pensionable earnings, potential return on pension and tax implications.

- The table and examples have been prepared using QPP maximum pension amounts. As previously mentioned, few workers are entitled to the maximum pension. However, the reasoning remains the same for pensions below the maximum.

Consider the impact of annual annuity increases

It’s interesting to consider the pension increase in terms of the percentage increase of the pension for each deferral year. For example, as shown in the table above, if the annuity is taken from age 61 ($12,444) instead of age 60 ($11,005), it will be 11.25% higher. It can also be seen that the annual deferral gain gradually decreases from 11.25% to 5.59% from age 61 to 72.

Insuring survival risk

Postponing the annuity period allows you to insure the risk of survival, i.e. to benefit from a stable income if you are lucky enough to live to a ripe old age.

As a guide, the following table gives the probability that a 65-year-old woman or man in 2023 will reach a certain age. For example, a 65-year-old man in 2023 has a 25% chance of reaching 94.

Source : CFFP Université de Sherbrooke, Septembre 2023, Quand débuter ses prestations de retraite, les Avantages de la flexibilité p.14 IQPF Normes d’hypothèses de projection.

Pension protection at age 65

A retiree who chose to defer his or her pension after age 65 could suffer a negative impact on pension calculation due to the fact that he or she earned no work income during the deferral period and did not benefit from the full annual pension increase of 7.2% per year of deferral.

As of January 1, 2024, years of low or zero earnings during the deferral period after age 65 will no longer negatively affect the pension calculation. The retiree will also be able to benefit from the full annual pension increase of 8.4% per deferral year.

It is likely that, thanks to this new measure, more pensioners will differ the start of their pension after age 65.

Few retirees differ their QPP pension after age 65

Despite the recent increase in the deferral bonus to 8.2% per year after age 65, only 8% (6% + 2%) of retirees had chosen to defer their pension after age 65 in 2022. However, this proportion is higher than in 2017, when only 4% (3% + 1%) of retirees deferred the start of their pension after age 65.

One might even think that those who claimed it after age 70 had simply forgotten to claim it, since the option of deferring the annuity from age 70 to 72 was only introduced in 2024.