Fiscal and Financial Planning Guide 2024-2025

Retirees > QPP pensioner who is still working after age 65

Choosing to stop contributing to the QPP

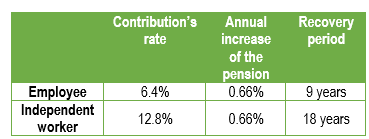

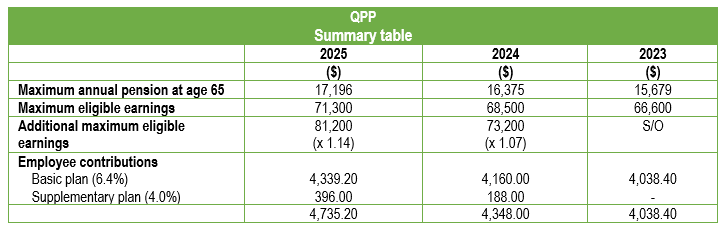

Workers over age 65 who receive the QPP pension and contribute to the QPP see their annual pension increase by 0.66% the following year.

For example, if the salary is $71,300 in 2025, the pension will increase annually by $475 ($71,300 x 0.66%) in 2025.

The required contribution is $4,339 for an employee ($8,320 for a self-employed worker).

Workers (salaried or self-employed) who receive a QPP pension may choose to stop contributing to the plan since January 1, 2024.

Each situation must be analyzed individually, but generally speaking, it would be advantageous to continue to contribute for an employee (6.4%), while a self-employed person whose contribution is double (12.8%) for the same pension increase (0.66%) could benefit from choosing to stop contributing.

Form to be produced

Employees who choose to stop contributing must complete the following form and submit it to their employer;

- Election to Stop Contributing to the Québec Pension Plan, or Revocation of an Election (RR-50 (2024-1))

The decision not to contribute is not final. It may subsequently be revoked.

Continue to work after age 65?

In the context of labour shortages, governments have introduced or improved a number of measures to encourage seniors to continue working and to allow them to stay active or to make ends meet.

Working income exemptions for the calculation of the Guaranteed Income Supplement (GIS)

Seniors who turn 65 years old of age and would like to continue working part-time often hesitate to do so because they fear losing their Guaranteed income supplement, often called the ″big pension″.

First, let us remind you that, starting at age 65, people are generally entitled to receive the Old Age Security (OAS) ($ 8,620 in 2024)

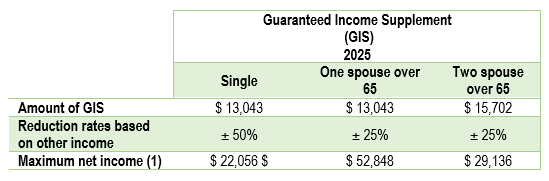

In addition, individuals with low income can also receive a second pension, the GIS, to a maximum annual amount of $13,043 ($15,702 for a couple). However, the GIS is quickly reduced based on other income earned at a rate of 50% (25% for a couple) for every dollar of additional income (ex: working income, QPP pension, investment income).

It is to be noted that the OAS income do not reduce the GIS.

(1) The following incomes are excluded in the reduction calculation:

- OAS

- Working income

- First $5,000

- 50% between $5,000 to $10,000

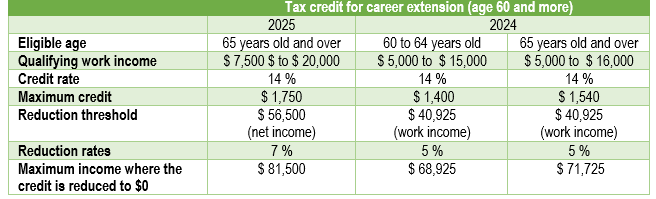

Tax credit for career extension (age 60 and more)

In its economic update, the Quebec’s government announced changes to the career extension credit. The main one will exclude workers aged 60 to 64.

In addition, the credit will be reduced on the basis of net income (work income, pension income, investment income, etc.) rather than work income alone.

Work Premiums

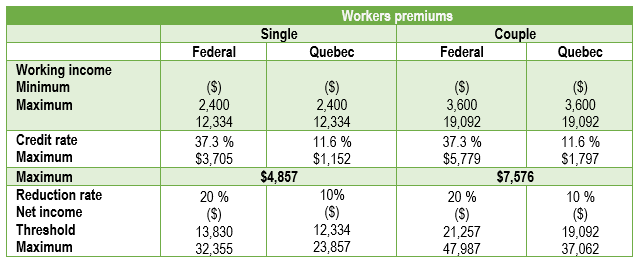

To increase income of low-income workers a “bonus” system payable along with the tax returns was introduced by both levels of government a few years ago.

A single person earning between $2,400 and $12,334 will be eligible for a bonus of nearly 50% of salary up to a maximum of $4,857. For a couple without children, the 50% bonus applies to salaries in the range of $3,600 to 19,092 up to a maximum of $7,576. The bonus is gradually reduced when net income exceeds the previous maximum.