Fiscal and Financial Planning Guide 2024-2025

Families > Family allowance for children 2024

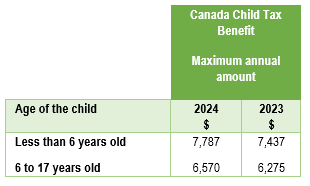

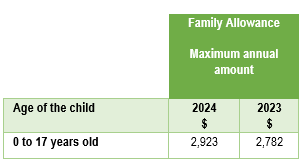

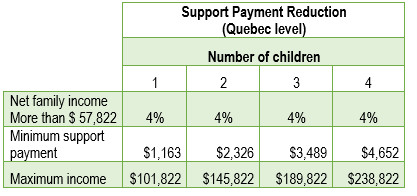

The following tables show the amounts of the Canada Child Benefit as well as the Support Payment paid by the Québec Government in 2024.

Federal – Canada Child Tax Benefit (CCTB)

The maximum annual CCTB amount is $7,787 per child under age 6 and $6,570 per child aged 6 to 17.

Quebec – Family Allowance (FA)

The maximum annual FA amount is $2,923 per child aged 0 to 17.

Reduction thresholds

These amounts are not taxable but are gradually reduced when the family income exceeds $36,502 at the federal level and $57,822 at the Quebec level.

Examples

The following tables show the amount of family allowances that a family may receive from both governments based on family income and the age number and age of the children.

Please note that there are calculators on government websites that allow you to calculate these amounts more precisely according to your own situation (see link below).

- Federal: https://www.canada.ca/fr/agence-revenu/services/prestations-enfants-familles/calculateur-prestations-enfants-familles.html

- Quebec: https://www.rrq.gouv.qc.ca/fr/services/services_en_ligne/soutien_aux_enfants/Pages/calcul_aide.aspx

The amounts of family allowances are adjusted on July 1st of each year on the basis of the family net income from the previous year’s personal tax returns.